owe state taxes illinois

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. This could be because your income increased and it bumped you.

E File Illinois Taxes E File Com

All taxpayers who are current with their tax returns are eligible to apply for a state of Illinois tax payment plan.

. It is possible to owe Illinois taxes and get a refund from your federal return in the same year. Generally an installment agreement will be automatically accepted if you owe. The Illinois income tax was lowered from 5 to.

For traditional corporations the tax is 25 of net income and for other forms of business the tax. You need to print out your tax return form IL-1040 and look at line 11 net income. Your employer will withhold money from each of.

The Illinois Federal State Exchange is saying I owe them 10k in back taxes for not filing in 2017 and. That makes it relatively easy to predict the income tax you will have to. Answers others found helpful.

Federal and state tax laws and regulations are not the same. If it was 2068 then your tax would be 102 the. The states personal income tax rate is 495 for the 2021 tax year.

The second column Base Taxes Paid shows what you owe on money that. 17 to receive up to 700 in tax rebates as part of the states family relief plan. 15 hours agoIllinois residents must file their 2021 taxes by Oct.

All residents and non-residents who receive income in the state must pay the state. The only problem is that I wasnt living or working in Illinois for those. To get the retirement-income tax exemption add up the retirement-plan income you reported on lines 7 8a 15b 16b or 20b of the federal Form 1040 and enter the total on Line 5 of your.

The tax seems too high if you made 2068. You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state. If you owe state taxes its likely because you did not withhold enough of your income throughout the year.

We have the authority to seize your real estate and personal property such as automobiles and business assets in order to collect past due tax penalty and interest. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. Up to 25 cash back This tax is based on a businesss net income.

The Illinois Tax Rate. However we will notify. The Illinois Federal State Exchange is saying I owe them 10k in back taxes for not filing in 2017 and 2018.

Under the Illinois Family Relief Plan passed by the Illinois House and Senate one-time individual income and property tax rebates will be issued to taxpayers who meet certain income.

Illinois Sales Tax Calculator And Local Rates 2021 Wise

Welcome To The Illinois Department Of Revenue

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

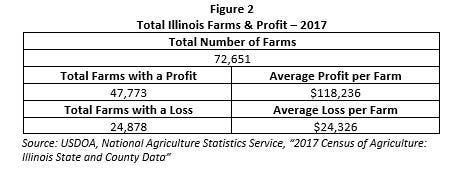

Illinois Farms And The Fair Tax How Will The Farming Industry Be Impacted By Ctba Ctba S Budget Blog

Il State Of Illinois Comptroller Letter Stating I Owe Money R Legaladvice

Illinois Used Car Taxes And Fees

S Corp Illinois Filing Process For Small Businesses

Want A Second Home To Avoid Illinois Income Tax Illinois Residents Leave

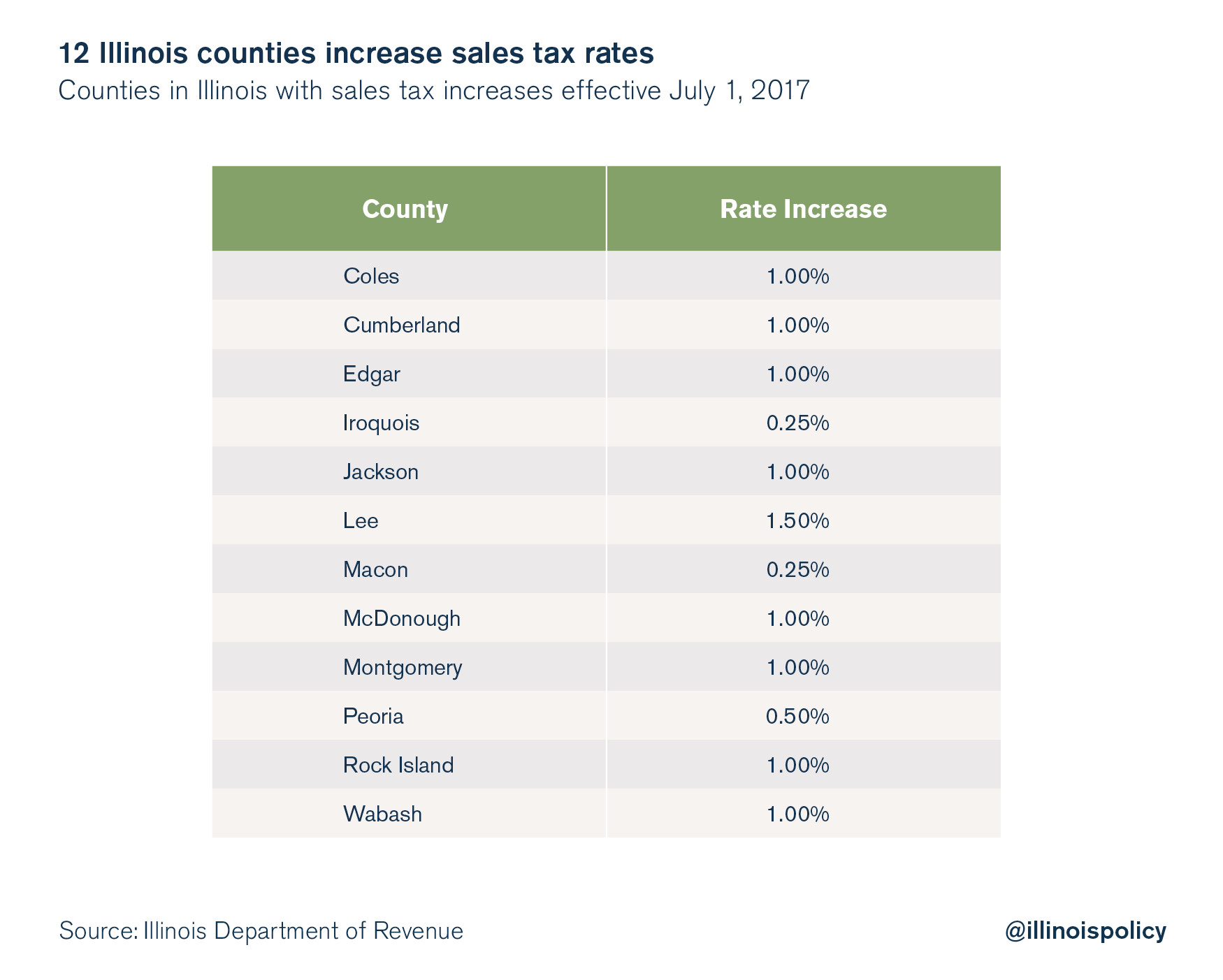

Sales Tax Hikes Take Effect In 50 Illinois Taxing Districts

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

How To Avoid Suspension Of Professional License Due To Unpaid Illinois Taxes Business Tax Settlement

Illinois State Tax Software Preparation And E File On Freetaxusa

Illinois Department Of Revenue Suspends Grocery Tax Kemper Cpa

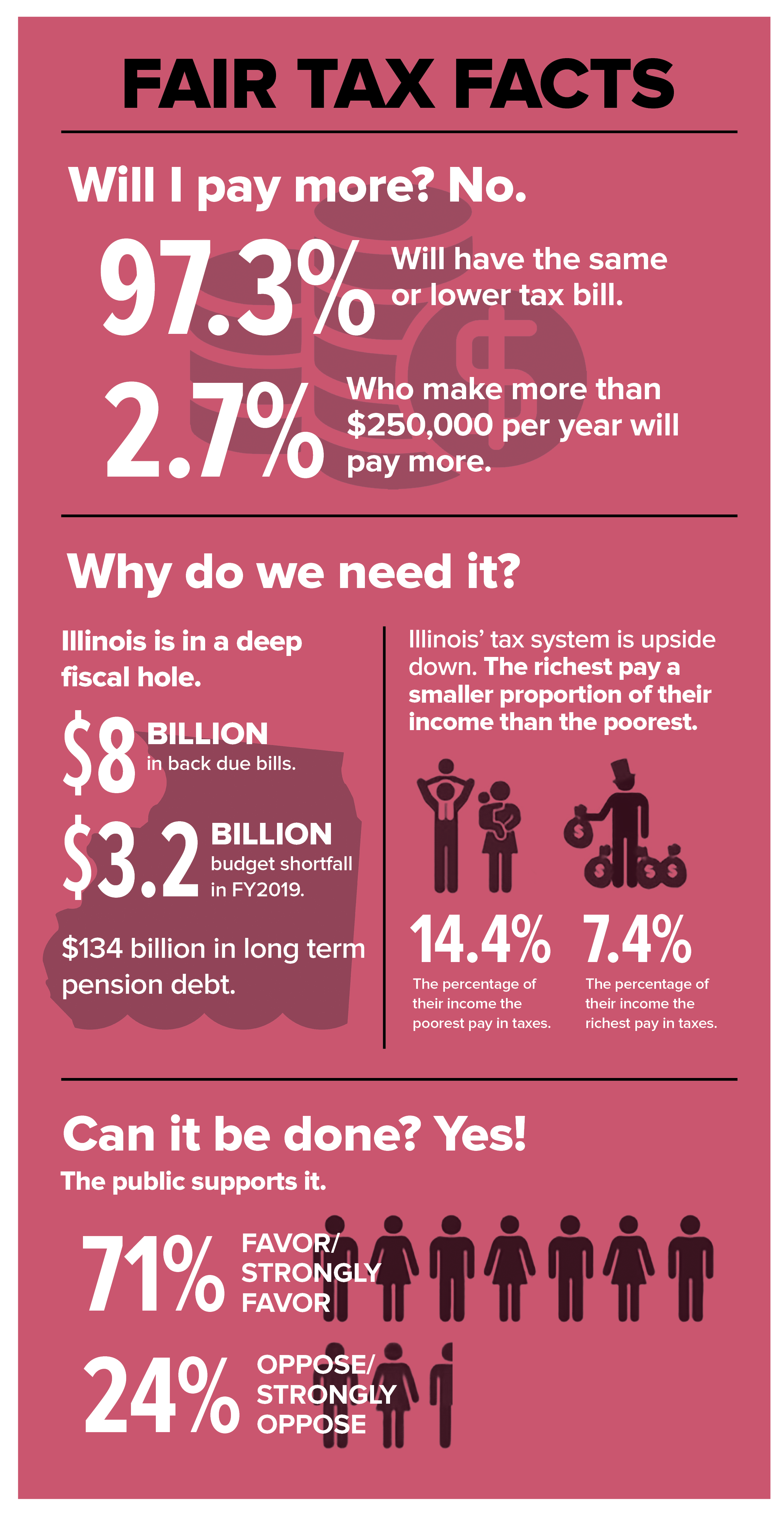

In Illinois Two Wealthy Men Battle Over What Fair Taxes Are Non Profit News Nonprofit Quarterly

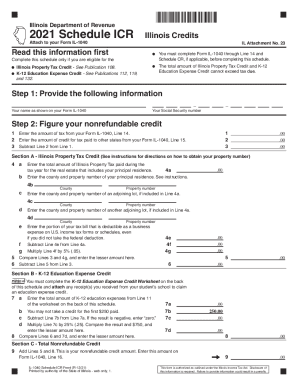

2021 Form Il Il 1040 Schedule Icr Fill Online Printable Fillable Blank Pdffiller

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Illinois Taxpayers Could Be Entitled To Refunds Of 840 Or More Due To 2018 Taxes Are You One Of Them Gobankingrates